Moving Forward as a Widow

Moving forward as a widow requires courage and intention. Here are a few ways to help you move forward in acceptance:

1. Acknowledge Your Journey: Recognize and honor the journey you've undertaken. Every tear, every moment of pain has brought you to this point of acceptance. It is a difficult road to travel, and it’s important to acknowledge the enormity of what you have gone through.

2. Prioritize Self-Care: This is one that I did not do well in my journey through grief until I was forced to. I had been burning the candle at both ends for too long, and it caught up to me. Be sure to listen to your body, rest when needed, exercise, spend time in nature and do things that fill your cup.

3. Seek Support: Engage in support groups or counseling. Sharing your journey with others who understand can provide comfort and a healthy outlook. Staying involved in my local church and getting one on one counseling was vital to my healing. It helped me gain perspective, understand unhelpful thought patterns and behaviors I was unaware of and change them, and see how the Lord had been working in my life, even through my overwhelm.

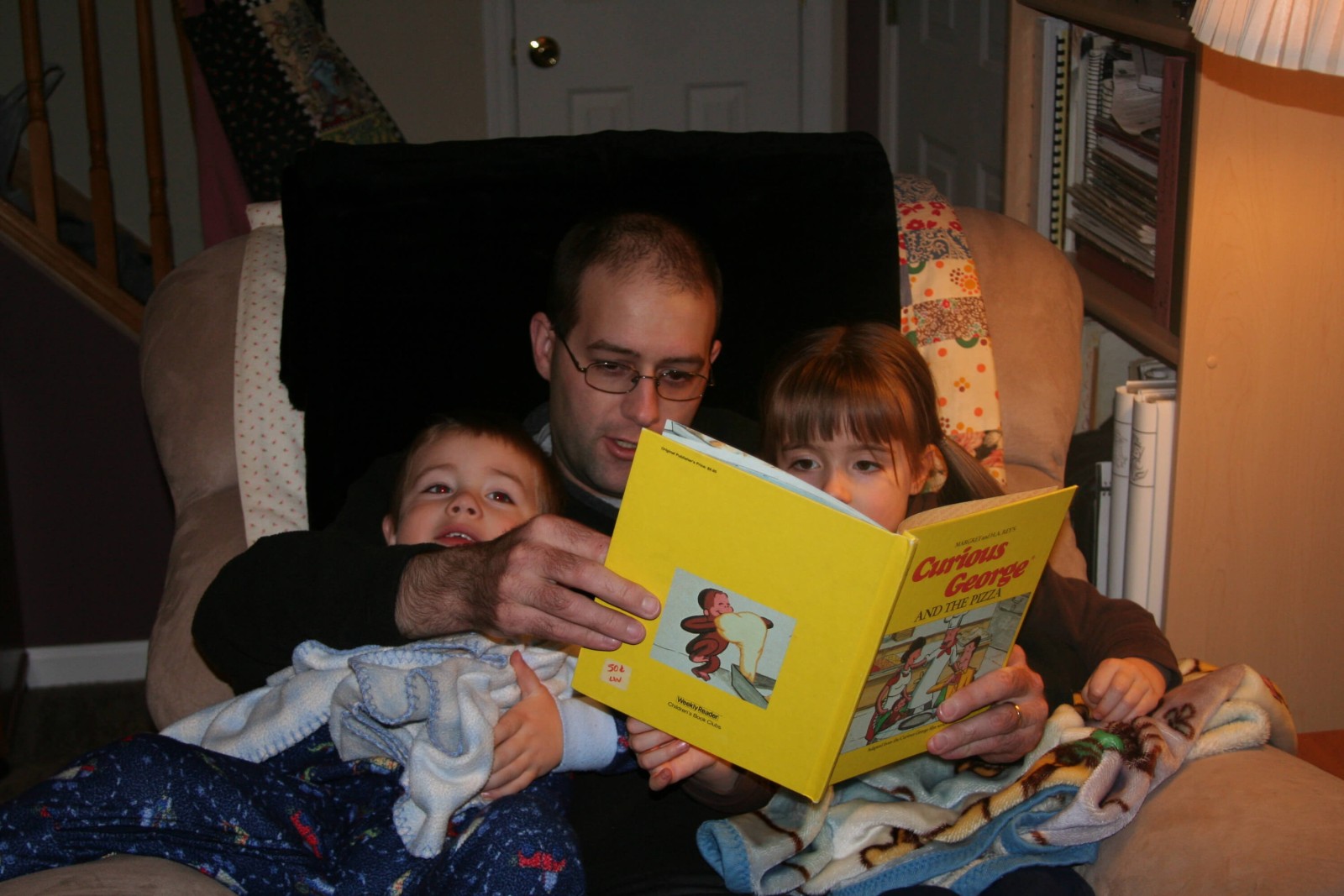

Read more...I don't normally post more than once a week, but today is the anniversary of Jon's passing, so I thought it would be appropriate to reflect on the changes that have occurred over the years.

It’s been 15 years since Jon passed. SO much has happened in 15 years.

Read more...The Benefits of Acceptance

Acceptance is a critical milestone in the grieving process. It allows for genuine healing to begin. By facing the reality of your loss, you open the door to emotional recovery. Acceptance also fosters resilience by helping you to adapt to your new life circumstances. This stage can bring a sense of peace and relief, freeing you from the heaviness of intense grief and denial. It enables you to cherish the loving memories of your spouse without being consumed by overwhelming sorrow.

In my life, I have noticed that the stages of grief come and go. They are intertwined, and sometimes I have found myself in more than one stage at the same time. Acceptance is a process. I believe I went in and out of acceptance and back into several of the other stages before finally fully settling in acceptance. There have been times when I have relapsed into an earlier stage due to a difficult life circumstance or a sudden loss that took me by surprise, and I would fall back into depression or anger. Difficult seasons have taken me right back to the trauma of the events surrounding my husband’s illness and death, and I feel like I am grieving all over again. But it doesn’t last, and I find that even though it is challenging to get through, acceptance is right around the corner.

Read more...Acceptance

Our conclusion to this series comes with a great deal of hope. The last stage in the stages of grief is acceptance, and it encompasses the convergence of understanding, healing and hope. Acceptance is intricately woven into the other stages, and as you work through each stage, there is an element of acceptance in each of them.

Read more...Continuation of six tips that helps me navigate depression:

3. Stay Connected: Reach out to friends and family, even when it feels difficult. Continue or start going to church and let someone know how you’re struggling. Isolation can deepen depression, while connection fosters healing.

4. Set Small Goals: Celebrating small victories, like doing the dishes or eating a meal, can provide a sense of accomplishment and hope.

5. Find Meaning: Engage in activities that honor your loved one’s memory. This could be volunteering for a cause your loved one supported or creating a scrapbook of your memories. My daughter and I planted flowers at my late husband’s grave one summer, and it was not only a way to honor him, but it also helped her find a measure of comfort by doing something for Daddy.

Read more...